The Finance Seer loves First Time Buyers. We’ve all been there! We remember it well. You’re standing at the foot of the proverbial mountain, about to delve into the greatest financial commitment of your life… But none of it makes sense. Allow us to bring perfect clarity.

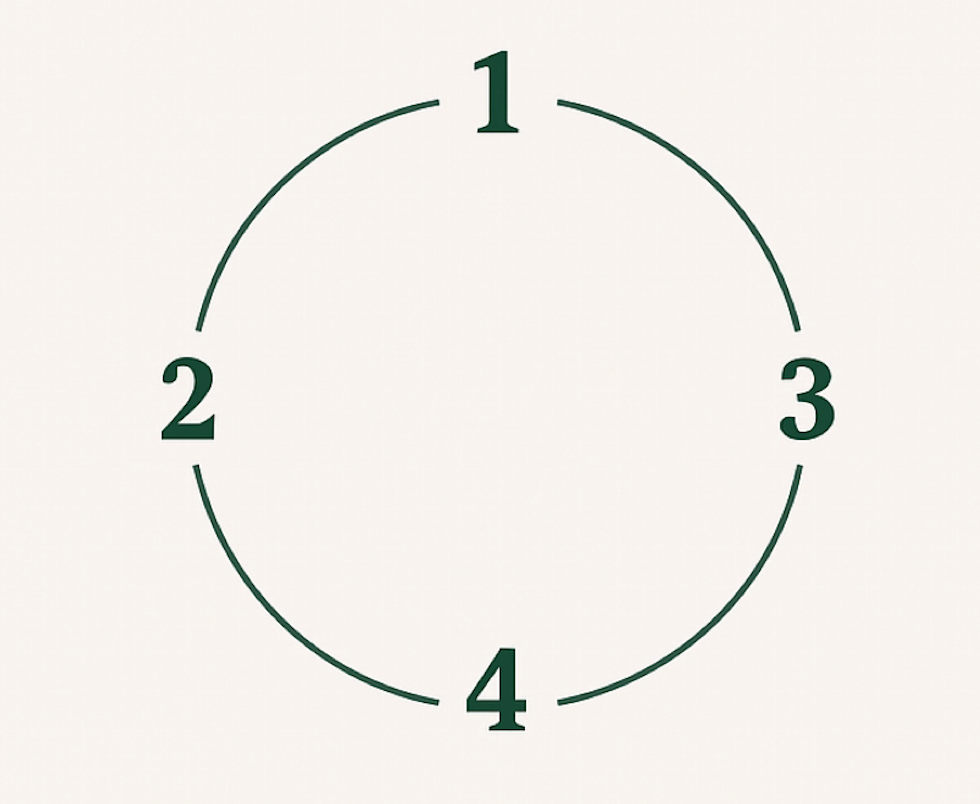

We will help explain the house buying process and the mortgage options available to you in plain English. We will guide and support you throughout the whole process, ensuring you are confident at every stage. From initial phone call, to submitting the mortgage application, to liaising with your solicitor to the point of completion, we will be there.

We realise that your anxieties and queries don’t start at 9 a.m. and finish promptly at 5 p.m. We offer an out of hours broker service, operating until 10:30 p.m. each night. When you need us, or have that burning question that needs answering, we will be there.

When planning for your first mortgage.

The best starting place is a no-obligations chat with one of our highly competent advisors. This is a no-obligations phone call, usually about lasting about ten minutes, where we establish your goals and ambitions framed in context to your current background.

Before you can make an offer on a property that an estate agent can put to their seller you need three things: ID, proof of your deposit and an Agreement In Principle (AIP). This is sometimes referred to as a Decision In Principle (DIP). We can organise this for you.

It’s wise to view your credit report to see how it is certain lenders will view you. You can view it via Check My File. Click the link to try it for free for 30 days, it’s then £14.99 a month after that but you can cancel any time. Feel free to Click here and get started.

A full mortgage application and assessment by a lender’s underwriters will be looked at in conjunction with a valuation report on the property you wish you purchase to determine in a full mortgage will be offered.

Let us negotiate with the estate agents for you!

The Finance Seer has the fortune of working alongside numerous estate agencies. We know property. We know estate agents. Most importantly, we know how to negotiate property purchases with estate agents. Let us take the stress out of it for you and negotiate a purchase on your behalf. We are not bound by geography. Brighton to Barnsley, London to the Lake District, we are happy to negotiate on your behalf.

Try our mortgage calculator to help you understand what a monthly payment may look like or how much money you’re likely able to borrow from one of our lenders.

Our trained experts are on hand to help in anyway they can. Booking a no obligation call doesn’t sign you up to anything, but we pride ourselves on you being in a better place at the end of the call no matter the outcome.